What Kind of Businesses Need a Liquidity Provider in 2025?

Liquidity is a term that has become popularized ever since its first use in the 19th century to denote the ability to convert an asset into cash quickly without any appreciable loss in value.

Today, many companies employ the term to market occurrences, price and values of certain assets, etc.; however, not all businesses should be doing so because the term is exclusive to the financial industry. Yet, in this sector as well there are several types of businesses, and not all of them need liquidity.

In this article, we will explore liquidity and the importance of liquidity providers in the financial market. We will also look at the kind of businesses that require liquidity providers, and how you can find a liquidity provider in 2025 if you own one of those businesses. Let’s dive in.

Impact of Liquidity Providers on the Financial Market

Let us start by defining the term liquidity.

Liquidity is simply the ease with which an item, be it cash or an asset in this scenario, can be converted into cash without losing its value greatly. For instance, money in your pocket, or your checking account is highly liquid because you can spend it right away. But this is not liquid as in the case of a home or car where the money may not be gotten easily until after selling the asset.

It goes without saying that higher liquidity makes it easier to manage your money and pay for things when needed.

Liquidity providers, on the other hand, are those individuals or institutions that help to make an asset easily tradable by converting it to cash.

To explain this concept, imagine you want to buy or sell a bond. The liquidity provider is the one who is willing to buy from you or sell to you at any time. Their job is to ensure that there is always someone on the other side of your trade.

Without liquidity providers, it would be hard to buy or sell assets quickly, and the prices could fluctuate a lot. This is what makes liquidity providers significant in the financial market. Their functions are summarised as:

Liquidity providers help ensure smooth trading by allowing assets to be bought and sold easily.

They help keep the market stable and efficient.

- They connect buyers and sellers, offering quick access to cash.

- They reduce the gap between buying and selling prices, lowering costs for investors.

- During market turbulence, liquidity providers step in to prevent large price swings.

Types of Liquidity Providers

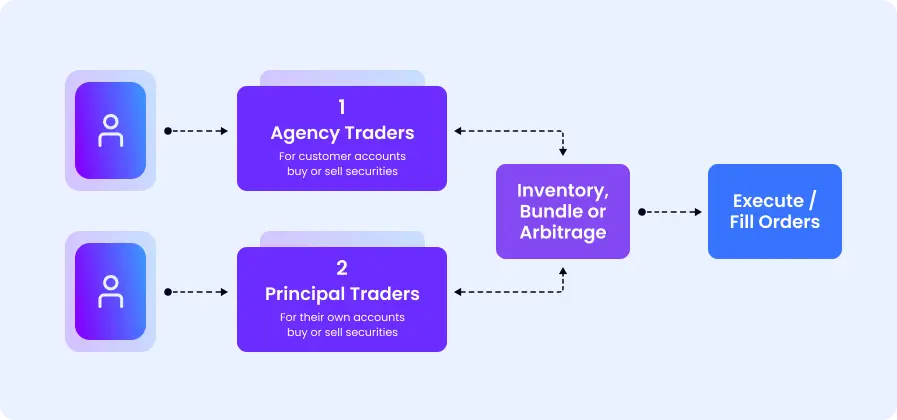

There are different types of liquidity providers in the financial market.

Market Makers

Market makers are firms that continuously buy and sell assets, providing liquidity by quoting both bid and ask prices. They help stabilize prices by ensuring that there is always a market for trades on both sides.

2. High-Frequency Trading (HFT) Firms

HFT firms take advantage of algorithms and technology to provide the market with liquidity. They do this by seizing small price movements to provide quick buy and sell orders.

3. Institutional Investors

Large financial entities, such as big banks, hedge funds, and pension funds, also supply liquidity by trading significant volumes of assets. Their large transactions help maintain liquidity in the market.

4. Proprietary Trading Firms

These companies contribute to liquidity by trading using their own capital and strategies, while also seeking profit.

5. Central Banks

Central banks can also operate as liquidity suppliers in financial markets, especially during periods of market stress or crisis. They can provide liquidity using a variety of monetary policy tools, including open market operations, lending facilities, and asset purchase programs.

6. Hedge Funds

Hedge funds are critical in providing liquidity to the equity markets. By participating in several trading operations, hedge funds contribute to a consistent market buying and selling flow.

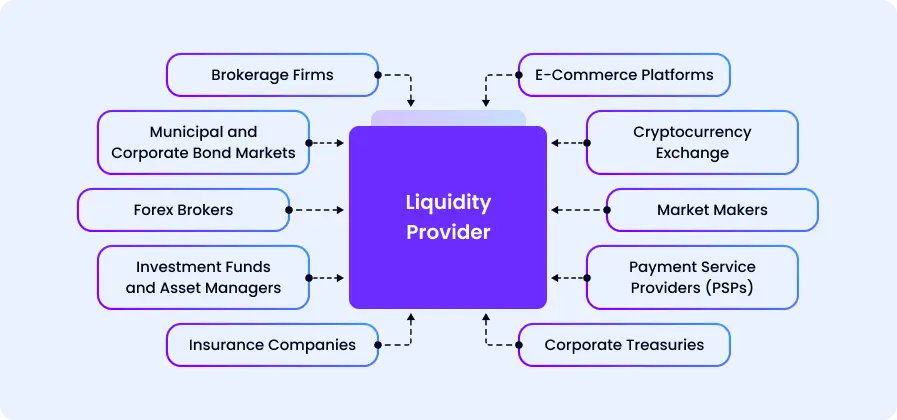

What Type Of Businesses Require a Liquidity Provider

Generally, industries that depend on liquidity to function well typically require a liquidity provider.

This is a list of the main ones:

1. Forex Brokers

The forex market needs high liquidity for traders to execute trades quickly and smoothly. Hence, they require LPs to contribute to liquidity.

2. Stock Brokers

Stock brokerage firms utilize liquidity providers to ensure that there are enough buyers and sellers for the stocks they trade on behalf of clients. Without LPs, they won’t be able to execute trades for their clients at competitive prices.

3. Market Makers

Although market makers are a major type of liquidity provider, they also require other liquidity providers to hedge their positions effectively and manage risks.

4. Hedge Funds and Institutional Investors

Large financial entities like hedge funds and pension funds often engage liquidity providers to execute large trades without impacting market prices. They need liquidity to enter and exit positions smoothly.

5. Investment Funds and Asset Managers

Similarly to hedge funds, investment funds and asset managers need liquidity providers to enable them to place large order quantities without gravely affecting market prices.

6. Cryptocurrency Exchanges

A crypto exchange cannot exist without liquidity. Crypto exchanges rely on liquidity providers to ensure that trading activities are always running and there is always an active market for all types of cryptocurrencies.

7. E-Commerce Platforms

E-commerce sites are those which provide services for carrying out purchase and sale activities for numerous products and services.

They depend on LPs to help them handle multi-currency transactions whilst avoiding foreign exchange risks. This way, e-commerce platforms can provide several payment choices to clients in different areas, thereby enhancing the user experience and their presence in the global market.

8. Payment Service Providers (PSP)

Payment Service Providers (PSPs) act as the middleman between the merchant and customer when it comes to payment processing. To do this effectively, they leverage LPs in the handling of cash flows and settlements, particularly in cross-border operations.

9. Corporate Treasury

While the concept of a corporate treasury is associated with financial management, their responsibilities extend beyond. Corporate treasuries oversee operational issues of cash flow continuity and manage risks and opportunities for multinational corporations. To do this effectively, treasuries often collaborate with LPs, as an ally in managing cash demand and in mitigating possible sources of financial risk.

10. Municipal and Corporate Bond Markets

These bond markets rely on liquidity providers to ensure a steady secondary market for their bonds.

How to Find a Liquidity Provider in 2025

If you are looking to employ the services of a liquidity provider in 2025, then these are certain criteria and aspects you should look out for.

1. Reputation and Track Record

Choose and stick with the best liquidity providers. Check to make sure that these providers are highly reliable and are constant performers even in a bear market.

2. Multiple Liquidity Sources

Consider LPs that have access to more sources of liquidity, including various qualified investors, MMs, and other potential sources of liquidity. This diversification helps ensure that there are other options in the occasion that one of the sources is affected.

3. Technological Capabilities

Evaluate the technological resources of the liquidity provider such as the trading algorithms of the firm, connectivity and the risk control system it has put in place. These capabilities also facilitate the capacity of the provider to respond to new market trends to ensure there is always liquidity.

4. Regulatory Compliance

Check to make sure that the LP has all the necessary licenses and registrations in their jurisdictions. They should also comply with all the regulations governing the financial industry.

5. Customised Liquidity Solutions

Search for the LPs that allow you to customize certain aspects to your specific taste. specific Such level of customization will allow a better match with your business needs.

6. Transparency and Reporting

In selecting LPs, you should be looking out for the most transparent ones, especially on issues to do with liquidity management, execution and other aspects of their performance.

7. Maintenance and Communication of the Relationship

When evaluating the liquidity providers, do pay heed to the frequency and quality of the communication between your business and them as well as the provider’s interest in providing a close working partnership in regards to meeting or overcoming the liquidity issues/challenges or capital gain opportunities.

Conclusion

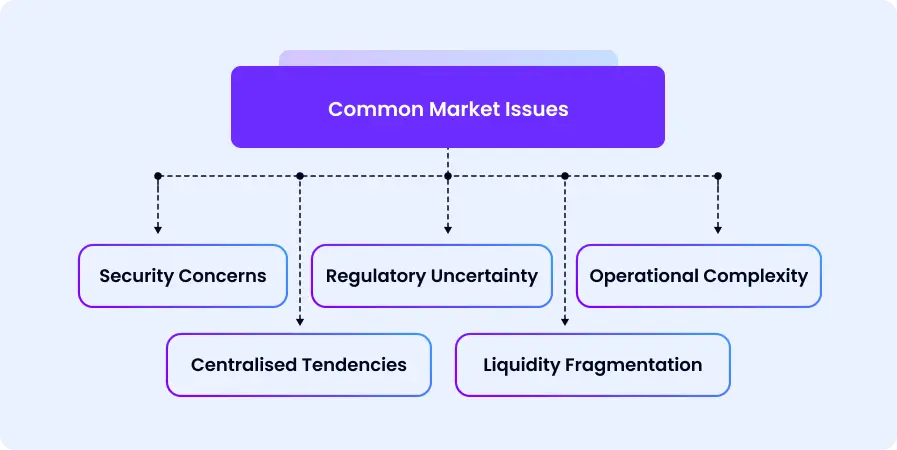

As you have seen, the importance of liquidity in the financial market cannot be overestimated. Hence liquidity providers need to explore more novel and advanced ways to increase and contribute to liquidity in the market.

Ready to Find the Right Liquidity Provider for Your Business?

At WL Global Solutions, we specialize in connecting businesses with tailored liquidity solutions that ensure stability, efficiency, and profitability. Whether you’re a forex broker, crypto exchange, or institutional investor, our expertise and network of top-tier liquidity providers can help you stay ahead in the competitive financial markets of 2025.

Partner with us today and future-proof your business with customized liquidity services. Still not sure? Schedule a consultation call with us.

FAQ's

Q1: What is a liquidity provider, and why is it important?

A liquidity provider is an individual or institution that helps to make an asset easily tradable by converting it to cash. Without liquidity, it will be difficult to run trades smoothly, hence LPs ensure trades are always running by contributing to liquidity.

Q2: What should I consider when choosing a liquidity provider in 2025?

Factors to consider when choosing a liquidity provider include reputation and track record, regulatory compliance, multiple liquidity sources, transparency, technological abilities, etc.

Q3: Which industries rely most on liquidity providers?

Any industry that needs liquidity relies on LPs. Such companies include market makers, insurance firms, hedge funds, e-commerce platforms, crypto exchanges, etc.