What Is Crypto Prime Brokerage, and How Do You Launch One?

It can be difficult to remain stable and relevant as a crypto investor due to the harsh volatility of the crypto market, hence several solutions are emerging to tackle this issue.

One such solution is crypto prime brokerage. It is a new business model catering to institutions looking to enter the all-time highly volatile cryptocurrency market. It is currently on the rise as a viable solution offering to instil stability and longevity in the investment portfolio of financial institutions.

However, to adopt this business model, it is important to understand what it is, the services it offers, its significance in the market, how it differs from the traditional brokerage, and if it is safe and able to meet your needs. We will also look into the current challenges of this type of brokerage and how you can navigate them to ensure success. Let’s dive in.

What is Crypto Prime Brokerage?

The term “prime brokerage” is not new to the financial market in general, hence its easy adoption in the crypto market.

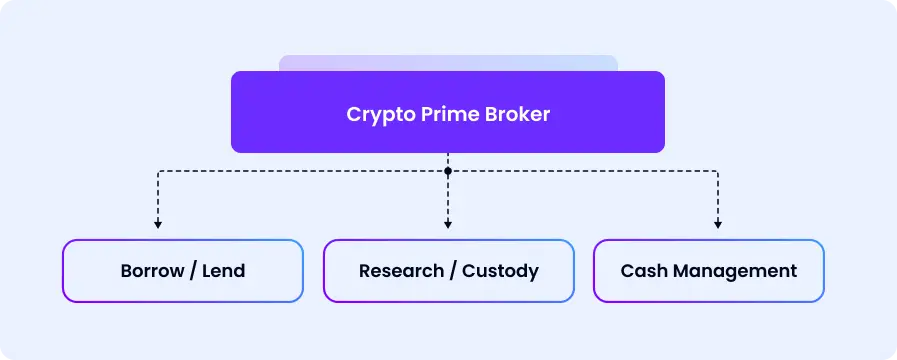

While a prime brokerage is a set of services offered by investment banks and other large financial institutions to hedge funds and investment clients, a prime broker is the institution that offers these services. Hence, a crypto prime broker offers services as well to investors and institutions, however, this time they are more tailored to crypto services.

These services include:

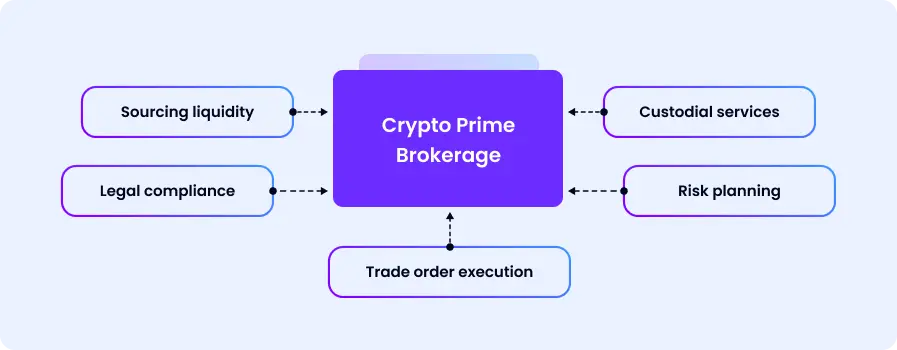

Trading Order Execution

The primary job of a crypto prime broker is to execute trade orders placed by investors. Similarly to traditional brokers, they exist to receive market position requests from investors and match them with suitable securities.

Liquidity

By acting as an intermediary between their clients and the marketplace, crypto prime brokers contribute to liquidity by either aggregating it from multiple sources or using over-the-counter (OTC) desks to help their clients execute large volumes of trades without affecting the marketplace significantly.

Custodial Services

The priority for any investor is always security, and prime brokers are aware of this. Hence, they also provide secure storage solutions for their clients.

These solutions could be online or offline storage options, depending on the preference of the client and what the broker offers him.

Risk Management

Crypto prime brokers also offer risk management services to their clients, easing the stress that could come with handling large volumes of trades alone.

They do this by leveraging their experiential knowledge of the financial market to offer timely and accurate financial advice.

Legal Compliance

Crypto prime brokerages also assist with the complex regulatory environment of crypto markets, which often also has no regulation at all.

Significance of Crypto Prime Brokerage in the Financial Market

It is no news that cryptocurrency is being adopted all over the world. According to Triple A, crypto ownership rates reached an average of 6.8%, with over 560 million cryptocurrency users worldwide in 2024.

Despite this staggering value, research shows that a lot of people are still yet to invest or trade crypto because of its volatility, liquidity fragmentation and market instability.

This is why the crypto prime brokerage emerged as a solution to tackle this problem by playing the role of a middleman between investors and the crypto market.

With a prime brokerage, investors no longer need to worry about executing trade orders, effective storage solutions or the safety of their digital assets.

The brokerages create a secure environment where investors can enter the crypto market with confidence, knowing they have a reliable partner to protect their investments and reduce the risks involved with digital assets.

Examples of these crypto prime brokerages include, GCEX, Nexo Prime, Zerocap, FalconX, Coinbase Prime, amongst others.

Prime Broker vs Traditional Broker

Though they may have similar roles, there are some very notable differences between a crypto prime broker and a traditional broker.

A prime broker's responsibilities include optimising a company's asset usage, settling transactions, monitoring accounts, and procuring liquidity.

Executing brokers, on the other hand, are simply responsible for finding a counterpart security or trader for each requested market order and settling it at the best possible market circumstances. This involves providing the tightest big-ask spread and ensuring minimal price slippage.

Let’s dive into more differences.

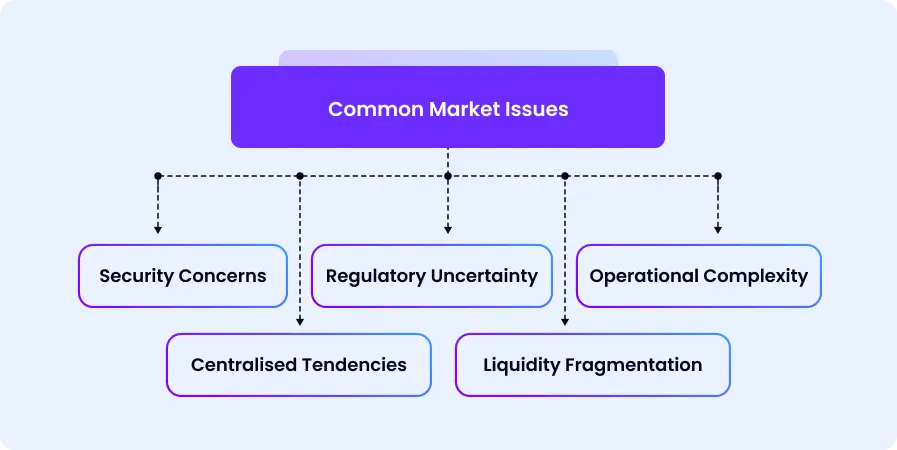

Current Crypto Prime Brokerage Issues

The establishment of a prime brokerage offering all of these attractive solutions to investors does not erase the presence of challenges.

Prime brokerages still have a few issues to tackle to become even more appealing to investors and hedge funds.

Regulatory Uncertainty

A crypto prime brokerage is not exempted from the regulation uncertainty in the crypto market.

Although the brokerage may be well vast in knowledge regarding regulations across different borders, sudden changes can still occur and disrupt the services of the brokerage.

Liquidity Fragmentatio

When it comes to liquidity, the crypto market is highly fragmented, hence the efforts of a prime brokerage in aggregating liquidity from multiple sources may still lead to inconsistencies.

Therefore, working with a prime broker account offers institutional players deep liquidity reach in one place.

Operational Complexity

Despite having extensive knowledge of the crypto market and its operations, the emergence of a wide range of services, including custody, liquidity aggregation, financing, and risk management, can still be operationally complex.

This complexity increases the likelihood of operational errors or system failures, which can disrupt services or lead to financial losses.

Centralised Tendencies

Most traditional-to-crypto transitions today still use a centralized approach to governance, risk planning, and asset optimisation, putting cryptocurrencies at danger of failure in the same manner that traditional banks have failed over time.

This increases the pressure on global prime brokers to devise innovative strategies to maximize the value of digital asset investments while avoiding repeating past failures.

Security Concerns

Although prime brokerages provide secure custody solutions, the threat of cyberattacks generally still remains high in the crypto space. Hence, even with top-tier security, the risk of hacking and theft can never be entirely eliminated, leading to potential loss of assets.

Recommendations for Investors Considering Crypto Prime Brokerages

As an investor thinking about trading in the crypto market, it is important to understand that while the prime brokerage offers appealing services, they still operate in the crypto space which is generally volatile, hence they are not exempted from the risks associated with the crypto market.

However, working with a crypto prime brokerage reduces these risks.

If you are ready to work with a crypto prime brokerage, these are a few things you should be looking out for:

1. Security Measures

Security is a non-negotiable in the crypto space, hence make sure that the brokerage provides advanced security features.

2. Liquidity Access

If you will be trading large volumes, then you need liquidity. Ensure that the brokerage can aid liquidity provision by aggregating from different sources.

3. Check the Fee

Since you will be paying, it is important to ensure that the fee aligns with your budget and the value you would be receiving.

4. Regulatory Compliance

It is important that the prime brokerage adhers to all regulatory norms.

5. Services Offered

Check for a brokerage that offers all the needs you desire. It is best when all the services you need are under one umbrella and offered by one brokerage.

6. Research the Brokerage's Reputation

Check for reviews, testimonials, and previous concerns or scandals to ascertain the brokerage’s reputation in the market.

7. Start with a trial period

If you can, by all means, start with a trial or a modest investment to ascertain if the brokerage aligns perfectly with your needs.

Conclusion

It is expected that the popularity of prime brokerages will grow as the crypto market continues to boom, however, it is important to perform indepth research to understand the offerings of these kind of services before patronising them.

FAQ's

Q1: What is a crypto prime brokerage and how does it differ from a traditional brokerage?

A crypto prime brokerage offers crypto tailored services, including optimising a company's asset usage, settling transactions, monitoring accounts, and procuring liquidity to large financial institutions and hedge funds.

Q2: What are the main services offered by a crypto prime brokerage?

The services offered by a crypto prime brokerage include; tradin gorder execution, liquidity, custodial services, risk planning and management, etc.

Q3: What should investors look for when choosing a crypto prime brokerage?

Criteria to look out for when choosing a crypto prime brokerage include, security, liquidity access, the brokerage’s reputation, regulatory compliance, etc.