Top 10 Crypto CFD Trading Strategies 2025

In CFD trading, success is often only attainable with a well-defined trading strategy. CFD is also known as Contract for Difference was introduced first in the early 1990s by London based financial services company IG group. As a way for traders to speculate on the price movements of various financial instruments without owning the underlying assets.The trader and the broker agree between themselves to replicate market conditions and settle the difference among themselves when the position closes.

CFD Trading Strategies are types of financial derivative, meaning when you trade in them, you are not trading the underlying assets, but a contract that is derived from its price. Traders make an assessment whether the price of an asset will arise or fall over a particular time.

Differences Between crypto CFD and Traditional CFD

Crypto CFDs are a good alternative to the traditional crypto CFD. Crypto Contract for Differences (CFDs) provide a different approach to profiting from the price movement of crypto assets. They are very much different from traditional CFD, where you need to purchase or own an item to gain from it.

CFDs are contracts between an investor and a broker speculating price movement of a specific cryptocurrency. In Crypto CFDs, you do not need to own the crypto asset, but you need to agree to the exchange difference in price between when you enter the contract and when you close it. This way, you are profiting from speculating the price of assets you do not own.

Advantages and risks associated with crypto CFD

This trading offers benefits of leverage and diverse trading options. You can control a large amount of cryptocurrency with a small amount of initial capital, thereby magnifying your potential positive trading outcomes. This trading allows you to enter short positions that accumulate positive trading outcomes during falling markets, instead of risking ones. It also enables you to gain access to a wide range of cryptocurrency assets, providing you with trading opportunities.

Cryptocurrency exchange markets are always open year-round, 24 hours a day, unlike most markets. The benefits of using leverage can also mean that losses can be as much gains and so it is like a double edged sword.

Crypto CFD comes with different risks or which are amplified losses that happen if the market moves against the position. Another risk associated with cryptocurrency trading is the high volatility of the market prices that are prone to extreme fluctuations, causing wild swings that can either lead to immense profits or significant losses.

10 Crypto CFD Trading Strategies

Position Trading

This strategy is also known as trend trading, where traders buy or sell assets and hold on to them for an extended period to make potential income from long-lasting trends in the financial markets. It is the practice of holding a position in crypto trading for a longer period of time. It involves understanding the bigger trends instead of rapid buying and selling.

Day Trading

This strategy differs from longer-term trading strategies, in that they focus more on profiting from shorter-term movements in the market. It involves entering and existing a trade with the aim of closing out the position by the end of the day. Day trading crypto is just like swing trading, but assets are only held for one or two days. The strategy can be used for both buying and selling an asset, allowing you to take advantage of both price increases and drops.

Swing trading

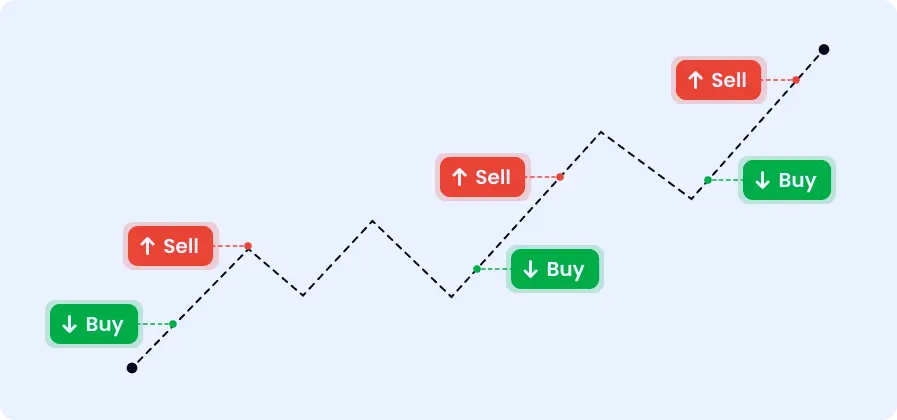

This trading is a style of trading whereby the trader attempts to profit from the price swing in a market. The goal of swing trading is to make profits from smaller price moves, usually within the wider trend. This is a good strategy can yield profits even in the short term. This can even be in the range of 10% to 30%. Traders hold a tradable asset for one or more days for profit.

Breakout Trading

This CFD trading strategy is popular among retail traders in the cryptocurrency market. It involves identifying key levels where the market price can 'break out' from a range or trend, indicating a significant movement in price. This strategy helps investors to benefit from breakouts in the market, making them earn or profit returns when the price moves outside support and resistance levels.

Pair Trading

This is a trading strategy that involves simultaneously buying one stock and selling another stock in the same sector or with a high historical correlation. Pair trading minimizes your risk due to the opposing positions taken. It can be executed in different market segments, reducing systematic risk. An effective crypto pair has the potential to achieve profit through simple and relatively low -risk positions.

Range Trading

This is a crypto trading strategy where traders get profit from the price oscillations of a cryptocurrency within a defined range. In an easy term, it involves buying at the bottom of a price range and selling at the top. In range trading, traders take advantage of price fluctuations with a defined trading range to make profit.

Scalping

It is a unique strategy that focuses on making little or small consistent potential profit. It's also a short-term trading strategy where investors or traders try to make a profit from small price movements just before and after executing a trade. Scalping enables you to start with a small deposit and multiply it within a single trading session. This trading involves low -risk as it uses only smaller- position sizes. Trading is easily done because smaller price movement occurs more frequently than larger ones.

Hedging

It is an advanced risk management strategy but involves buying and selling an investment to potentially help reduce the risk or loss of an existing position. Financial stability is maintained within the system because it provides greater flexibility related to your investment. It is important and useful in crypto trading.

Counter-Trend Trading

It is a crypto CFD strategy that includes buying and selling of a security that has experienced an impulsive bearish or bullish move in the hopes that a corrective move higher or lower will allow them to buy it back at that higher or lower price. They target corrections in a trending security's price action to make money. Counter trend strategy uses momentum indicators, reversal patterns and trading ranges to determine the best area to execute trades.

Algorithmic Trading

Algo trading, also known as algorithmic trading, is an automated system that uses computer programs and mathematical algorithms to execute transactions. This strategy is widely known in the crypto market. Algo trading is loved because it operates continuously and aids traders in executing transactions at rapid speeds yet with high precision.

Wrapping Up

Incorporating the use of efficient strategy, discipline and risk management techniques in trading will do you more good than harm. It will help you define your investment objectives, risk tolerance and time horizon. It will also help you avoid emotional decisions and stay committed to your strategy, limiting position size to manage potential losses and balancing gain with potential losses.

FAQ's

Q1: How to differentiate crypto CFDs from traditional CFDs?

Traditional investments require you to directly buy or possess an item in order to benefit from it. However, in crypto CFD, you do not actually possess the cryptocurrency asset, but rather agree to exchange the price difference between when you enter the contract and when you exit it.

Q2: What are the essential risk management practices for safeguarding investment?

Risk management practices consist of recognizing potential risks, devising a financial strategy, spreading out investments, and taking insurance into account.

Q3: What are the most suitable trading strategies based on individual preference and market conditions?

The most suitable trading strategies are position trading, day trading, swing trading, breakout trading, pair trading, scalping, hedging, counter-trend trading and algorithm trading.