Launching Your Digital Business in 2025? Here Are The Top 10 Crypto Business Ideas

The cryptocurrency market launched its flagship currency, Bitcoin, in 2009. Over a decade later, it has evolved into a multi-trillion-dollar ecosystem that has attracted the biggest corporate giants in the finance industry. The market is home to everyday traders, investors, and numerous entrepreneurs and founders. Recently, it has adopted more advanced technologies, such as Blockchain, Decentralized Finance (DeFi), Artificial Intelligence (AI), and others.

In 2025, notable crypto observers are predicting that the regulatory environment for cryptocurrencies will be better defined globally. This means that it is the perfect opportunity for entrepreneurs to capitalize on technology and launch their crypto business ideas. Businesses that align with emerging market trends and regulatory frameworks position themselves to be market leaders in various niches by the next decade.

Top 10 Crypto Business Ideas in 2025

In this article, we shall explore ten crypto business ideas with the highest potential to succeed in 2025, alongside the benefits and challenges of these businesses.

1. Crypto Exchange and Trading Platform

Crypto exchange platforms provide an interface for buying, selling, and trading digital assets. It is probably the most common business model in the crypto ecosystem.

● Benefits

○ Potential for high revenue generation from trading fees as the volume of transactions increases.

○ Increasing demand for reliable trading platforms due to the high influx of institutional and retail investors

● Challenges

○ Intense competition due to the number of established players in the market.

○ Security compliance requirements are tedious and expensive but necessary to protect users’ funds and data.

2. White Label Crypto Brokerage Solutions

White-label solutions give entrepreneurs the opportunity to launch their crypto brokerages without developing their platforms from scratch.

● Benefits

○ They offer quick market entry with lower initial capital investment

● Challenges

○ They are at risk of heavily depending on third-party providers for quality.

○ Their ability to customize the platform is limited.

3. Decentralized Finance (DeFi) Solutions

DeFi platforms provide decentralized financing services such as lending, borrowing, or even yield farming without the need for any other intermediary.

● Benefits

○ There is a high demand for transparency and decentralized lending by individuals.

● Challenges

○ There are a lot of complex protocols and regulatory uncertainties in the DeFi community.

4. NFT Marketplace

NFT marketplaces are platforms where users can buy, sell, and trade Nonfungibe Tokens (NFTs) like arts, collectibles, and so on.

● Benefits

○ Opportunities to create multiple revenue streams from the various types of NFTs, such as collectibles, gaming, and digital art.

● Challenges

○ The market is very volatile. The fluctuating demands in certain niches can be risky.

○ Ownership of intellectual properties has been difficult to manage strictly.

5. Crypto Payment Gateways

Crypto payment gateways are important in the ecosystem to ensure that merchants can accept popular cryptocurrencies as a method of payment.

● Benefits

○ The growing demand by merchants for easy and seamless cross-border transactions provides a very good market opportunity.

● Challenges

○ There are strict regulations on compliance and fraud prevention. The KYC/AML compliance process might be too tedious.

6. Blockchain Development Services

Technology entrepreneurs can consider rendering their services towards custom blockchain development. This will help crypto businesses find personalized solutions to their business problems.

● Benefits

○ The demand for specialized expertise in blockchain development is on the rise as the crypto market is getting more saturated.

● Challenges

○ The crypto ecosystem grows at a very fast pace. Technologies that support this ecosystem continue to evolve quickly, and it can be tedious to adapt to these technological changes.

7. Crypto Staking Platforms

A crypto staking platform allows users to lock up their crypto assets to support network operations in the ecosystem and earn passive income or other rewards. To understand it better, think of it as a fixed deposit account with a traditional bank.

● Benefits

○ The returns are attractive for passive earners opening up a niche target market to explore.

● Challenges

○ Building a platform that will house staked assets will require high-level security to protect the assets and customer data.

8. Crypto Wallet Development

Tech entrepreneurs and developers can also explore developing crypto wallets for businesses, either custom-built or as a white-label solution. Crypto wallets with intuitive interfaces and amazing user experience are important in the ecosystem for managing and conducting transactions involving crypto assets.

● Benefits

○ A Crypto wallet is a very important infrastructure in the ecosystem for crypto users. The capacity to build a standard wallet that can accommodate increasing demands positions your wallet development business favorably.

● Challenges

○ Ensuring high security while maintaining a great user experience can be quite tricky and difficult to balance.

9. Metaverse-based Crypto Projects

You could also consider integrating crypto with open avenues in the metaverse for innovative projects, particularly in Web3, virtual reality, and gaming.

● Benefits

○ There is a huge demand and market in Web3, gaming, and virtual demand.

● Challenge

○ The Metaverse is still in its early development stage, and there might be a lot of technical difficulties when trying to integrate platforms.

10. Crypto Tax and Compliance Solutions

This involves the use of automated tools for tax reporting and compliance.

● Benefit

○ There is a high demand, from both individual and institutional investors, for automated means to navigate tax compliance.

● Challenge

○ Compliance may be difficult since different countries and jurisdictions have different legal requirements.

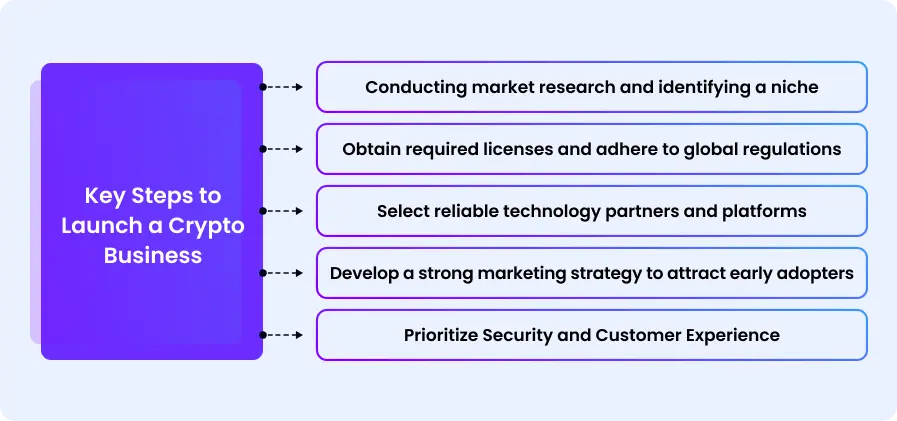

Key Steps to Launch a Crypto Business

Launching a crypto business can be a daunting process.

However, being strategic and intentional about adhering to some best practices can make the process seamless. Here are some important steps:

Conducting market research and identifying a niche: Proper market research helps an entrepreneur understand the target audience and ensures that the business understands how to cater to the needs of that audience.

Obtain required licenses and adhere to global regulations: Ensure that you are well informed about all licenses required for your business to operate and stay compliant with all relevant laws.

Select reliable technology partners and platforms: Be strategic about your choice of partner platforms. Ensure that they provide quality services and they are reliable.

Develop a strong marketing strategy to attract early adopters: Marketing is king in business. The first group of adopters may end up referring your business to others based on quality service.

Prioritize Security and Customer Experience: Never compromise on implementing the best security infrastructure and customer experience technology for your users.

Challenges to Consider

● Market volatility and competition

● Regulatory compliance and frequent changes

● Building trust in a new and emerging industry

FAQ's

Q1: What are the most profitable opportunities in the crypto market?

Crypto trading platforms, NFT marketplaces, and crypto payment gateways have the potential for the highest revenue if properly managed to navigate market competition and regulatory uncertainties.

Q2: How do I ensure compliance when launching a crypto business?

You should begin to stay updated on the latest regulations in the crypto ecosystem, both globally and in your region. You should also ensure you have obtained all required licenses and then consult the service of a lawyer.

Q3: What role does blockchain play in new crypto ventures?

Blockchain technology offers crypto ventures security, transparency, and decentralization. It promotes the democratization of the ecosystem and facilitates decentralized financing and digital asset management.