The Role of Tokenization in the World of Digital Assets

Asset tokenization is a significant concept. It serves as a bridge between traditional assets and the digital world. Innovations like Bitcoin, Ethereum, and blockchain technology, have made it possible to turn real-world assets into digital forms.

Consider this: you could own a piece of a valuable painting or a piece of property, even if you're not a wealthy investor. This democratization of investment opportunities is made possible by tokenization, which breaks down assets into smaller, easy-to-trade units on a digital ledger.

As more institutions and governments explore the potential of blockchain technology, we're seeing the vision of a more accessible and inclusive financial market take shape.

In this article, we'll delve into the process of asset tokenization, its significance in Decentralized finance, and the new opportunities it presents.

Definition of Asset Tokenization

Tokenization involves creating digital representations of assets through cryptography and storing them on a blockchain network. This process allows for the representation of a wide range of assets, including art, real estate, stocks, and even sensitive information. Different types of digital assets serve various purposes, such as stablecoins, which tie their value to other financial instruments, and non-fungible tokens (NFTs), which uniquely identify ownership of digital assets like music and art.

Asset Tokenization

Asset tokenization involves creating digital tokens on a distributed ledger, representing either digital or physical assets. These tokens ensure immutable ownership, as recorded on the blockchain, offering investors greater security and transparency.

Whether it's converting ownership of a property into tokens representing fractional ownership or creating digital currency for various objects of value, asset tokenization unlocks new opportunities for investors while ensuring secure custody of their assets on the blockchain.

How Does Asset Tokenization Work?

We will explain the process of asset tokenization in 4 steps.

1. The Asset. First, there must be an asset that you want to tokenize. From physical items like real estate and artwork to intangible assets like intellectual property, tokenization opens doors to a diverse range of assets, making ownership more accessible and secure.

2. Tokenization. This is where the transformation happens —those physical assets are turned into their digital counterparts. This is done by replacing the asset’s sensitive data element (like a credit card number or primary account number) with a non-sensitive substitute, ie, machine learning and algorithms.

The result is a token—an arbitrary data string with no clear structure or meaning. These tokens serve as digital keys, granting fractional ownership of the asset. The good thing about this is that the token and the original data asset bear no resemblance to each other. This makes it difficult for hackers to compromise the token.

3. Distribution. Once tokens are prepared, they're dispersed to investors, democratizing access to once-exclusive assets. Now, individuals of all financial backgrounds can own a share of something valuable. Whether it's a masterpiece or a high-end vehicle, the opportunities are boundless.

4. Trading. The excitement begins with trading your tokens. Gone are the days of waiting for transactions to settle. Asset tokenization facilitates continuous trading on global platforms, offering unmatched flexibility in buying, selling, and managing investments. With enhanced liquidity, assets are regularly exchanged, maximizing their potential in a dynamic market environment.

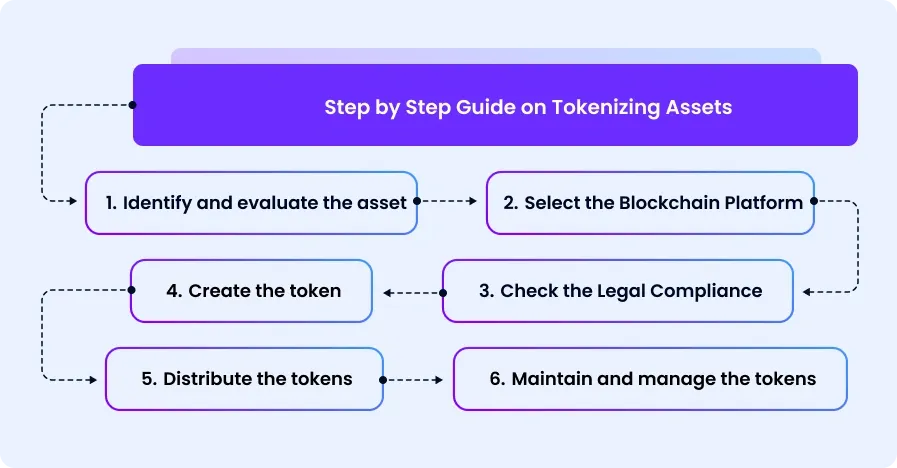

Step by Step Guide on Tokenizing Assets

1. Identify and evaluate the asset. First, the asset to be tokenized must be identified. It could be anything from real estate and artwork to stocks or intellectual property. You also need to evaluate the value of this asset.

2. Select the Blockchain Platform. Next, you'll need to determine which blockchain platform to use for the tokenization. Tron, Corda, or Ethereum can serve as viable options for utilization. In this stage, you also have to draft the smart contracts needed to operate on the blockchain network.

3. Check the Legal Compliance. You also need to ensure you comply with relevant laws and regulations governing the asset and its tokenization. This step involves legal documentation and agreements to ensure legitimacy and protection for all parties involved.

4. Create the token. At this stage, the asset is converted into digital tokens using blockchain technology. Each token represents a fraction of the ownership or value of the asset which is unique and securely stored on the blockchain. This process requires extensive coding knowledge.

5. Distribute the tokens. Once the tokens are created, they are now ready to be distributed to investors or buyers. This could involve offering them through a token sale, auction, or other mediums of exchange, depending on the asset and its market.

6. Maintain and manage the tokens. At this stage, the tokens can be freely traded on digital asset exchanges, providing liquidity and flexibility to investors. Ensure you are always up-to-date with the compliance standards, as the nature of digital tokens is always changing.

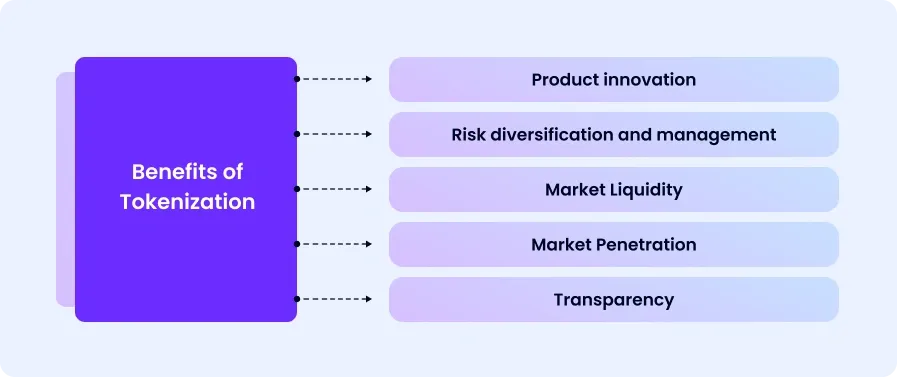

Benefits of Tokenization

Product innovation. Asset tokenisation can help to develop new hybrid financial products that combine the characteristics of traditional and digital assets. Asset tokenization, as an alternative asset class, allows capital market investors to diversify their portfolios.

Risk diversification and management. Asset tokenisation can be used to mitigate financial market uncertainty. It can be used to distribute risk among investors and to develop new investment vehicles that combine risky assets with less risky ones to manage volatility.

Market Liquidity. Market liquidity will improve because of the ease with which tokenized assets can be transferred. Asset tokenisation allows traditional instruments that are difficult to sell to be easily converted to cash, potentially increasing the volume and value of capital market trading activities.

Market Penetration. New financial products created through asset tokenisation will increase the flow of capital into the capital market, owing to increased retail investor participation.

Transparency. Blockchain technology allows participants to easily monitor transactions on tokenized assets in real time.

Use Cases for Tokenization in Blockchain

Real Estate. As previously stated, a commercial building can be tokenized and sold to a large number of investors, each of whom owns a portion of the property.

Art & Collectibles. Tokens, whether digital or physical, can represent art and collectibles and provide ownership of unique assets. Non-fungible tokens (NFTs) are commonly used to establish ownership of artwork and collectibles. Tokens, as distinct digital identifiers, provide investors with assurance about the authenticity and security of their assets.

Intellectual Property. Tokens can also represent intellectual property ownership, including patents, trademarks, and copyrights. This may make it easier to licence and trade intellectual property assets.

This type of transaction is extremely important in the Web3 ecosystem. New projects can easily transfer ownership using secure and convenient tokens.

Final thoughts

In the realm of cryptocurrency, tokenization plays a crucial role, enabling investors to convert nearly any asset into digital form for use or exchange. However, you needn't tackle the tokenization process alone.

FAQs

Q1. How does tokenization address the challenges associated with traditional asset transfer processes?

Tokenization streamlines asset transfer by converting physical assets into digital tokens, facilitating faster and more efficient transactions on blockchain platforms. This process also enhances transparency and security, mitigating risks associated with traditional paper-based processes.

Q2. What are the key benefits of tokenization for financial institutions and investors?

For financial institutions, tokenization offers opportunities for product innovation and risk diversification. It also improves market liquidity and transparency, attracting more capital into the market. For investors, tokenization provides access to a broader range of assets, increased liquidity, and enhanced transparency, resulting in more diversified portfolios and potentially higher returns.

Q3. How does tokenization enhance liquidity for illiquid assets?

Tokenization converts illiquid assets, such as real estate or artwork, into digital tokens that can be easily traded on blockchain-based platforms. This increased liquidity allows investors to buy and sell assets more quickly and efficiently, reducing the time and effort traditionally required to liquidate such investments.