How Do You Integrate Liquidity API inside Your Crypto Exchange?

In the dynamic realm of cryptocurrency trading, where market fluctuations occur in milliseconds, ensuring liquidity is paramount for the success of any exchange platform. Liquidity APIs play a pivotal role in this landscape, facilitating seamless transactions and enhancing market efficiency. This article explores the process of integrating liquidity API into your crypto exchange, addressing challenges, and emphasizing its importance in maintaining competitiveness.

Understanding Crypto Exchanges and Liquidity Providers

Crypto exchanges serve as vital bridges connecting buyers and sellers in the digital asset space. Liquidity providers, on the other hand, contribute to maintaining sufficient liquidity within these exchanges, ensuring that trading pairs are readily available for execution. Integrating liquidity APIs enables exchanges to tap into larger liquidity pools, fostering price stability and offering a wider array of currency pairs, thus attracting more traders.

Advantages of Liquidity API Integration

The integration of liquidity APIs offers several advantages to crypto exchanges. Firstly, it provides access to deeper liquidity pools, resulting in tighter bid-ask spreads and improved order execution. This, in turn, enhances the overall trading experience for users and boosts market confidence. Moreover, liquidity API integration allows exchanges to offer a broader range of trading pairs, catering to diverse market preferences and increasing trading volumes.

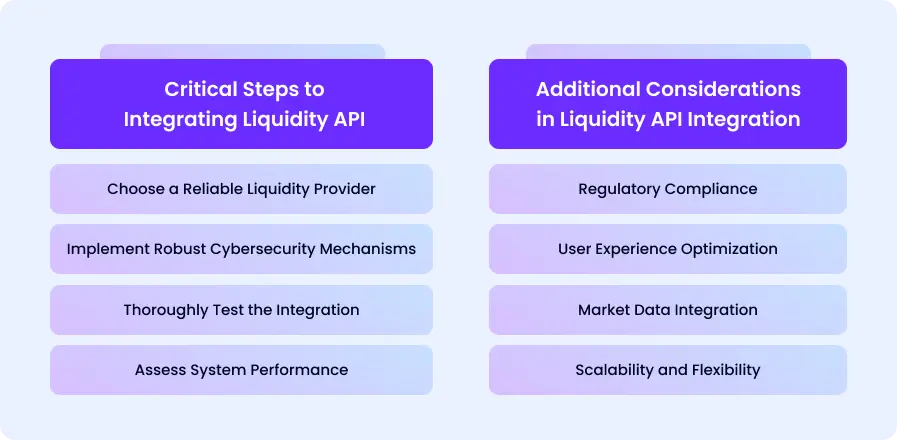

Critical Steps to Integrating Liquidity API

a. Choose a Reliable Liquidity Provider:

Selecting a reputable liquidity provider is paramount to the success of liquidity API integration. Factors to consider include the provider's technological capabilities, available features, pricing structure, and adherence to regulatory compliance standards. Conducting thorough due diligence and seeking recommendations from industry peers can help identify the most suitable provider for your exchange.

b. Implement Robust Cybersecurity Mechanisms:

Cybersecurity is a top priority in the crypto space, given the prevalence of cyber threats and hacking attempts. When integrating liquidity APIs, it is crucial to implement robust security measures such as two-factor authentication, encryption protocols, and regular security audits. This helps safeguard user funds and sensitive data, enhancing trust and credibility in your exchange platform.

c. Thoroughly Test the Integration:

Before deploying liquidity APIs in a live environment, it is essential to conduct comprehensive testing to identify and rectify any potential issues or bugs. This includes testing various trading scenarios, order types, and market conditions to ensure seamless functionality. Additionally, performing stress tests can help assess the scalability and resilience of the integration under peak trading loads.

d. Assess System Performance:

Monitoring the performance of liquidity APIs post-integration is crucial for optimizing order routing processes and ensuring smooth operation. Implementing real-time monitoring tools allows exchange operators to track key metrics such as order latency, fill rates, and slippage, enabling timely adjustments and optimizations as needed. Continuous performance evaluation helps maintain a competitive edge in the ever-evolving crypto market landscape.

Additional Considerations in Liquidity API Integration

In addition to the critical steps outlined above, several other considerations can further enhance the effectiveness of liquidity API integration:

a. Regulatory Compliance:

Ensuring compliance with relevant regulatory requirements is essential for operating a reputable crypto exchange. Before integrating liquidity APIs, exchanges must familiarize themselves with regulatory frameworks governing digital asset trading in their jurisdiction and implement necessary compliance measures.

b. User Experience Optimization:

Providing a seamless and intuitive user experience is key to attracting and retaining traders on your exchange platform. When integrating liquidity APIs, prioritize user interface design, order execution speed, and responsive customer support to enhance overall user satisfaction.

c. Market Data Integration:

Access to real-time market data is crucial for making informed trading decisions and maintaining competitive pricing on your exchange. Integrating market data feeds alongside liquidity APIs enables exchanges to offer up-to-date pricing information and market analysis tools to traders.

d. Scalability and Flexibility:

As your exchange grows and evolves, scalability and flexibility become increasingly important. Choose liquidity providers and integration solutions that can scale with your platform's growth trajectory and accommodate future enhancements and customizations.

Final Thoughts

Integrating liquidity API into your crypto exchange is not just a technical requirement but a strategic imperative for staying competitive in the rapidly evolving digital asset space. By partnering with reputable liquidity providers and implementing robust cybersecurity measures, exchanges can enhance market stability, attract more traders, and foster long-term growth and success. As the crypto market continues to mature, liquidity API integration will remain a cornerstone of exchange operations, driving innovation and efficiency in the global financial ecosystem.

In conclusion, integrating liquidity API is a fundamental step towards establishing a robust and resilient crypto exchange platform. By following the outlined steps and considerations, exchange operators can navigate the integration process effectively and capitalize on the myriad benefits offered by liquidity APIs. Embracing liquidity API integration not only enhances market competitiveness but also contributes to the broader adoption and acceptance of cryptocurrencies as a legitimate asset class in the global economy.

Contact us to get a full technical presentation on this TickTrader Liquidity Aggregator component.

FAQ: Integrating Liquidity API into Your Crypto Exchange

Q1: What is the role of liquidity providers in crypto exchanges?

Liquidity providers play a crucial role in crypto exchanges by ensuring that there are enough buyers and sellers for various trading pairs. They facilitate smooth transactions by maintaining sufficient liquidity, which is essential for price stability and efficient order execution.

Q2: How do liquidity APIs contribute to market stability and competitiveness?

Liquidity APIs contribute to market stability by providing access to larger liquidity pools, resulting in tighter bid-ask spreads and improved order execution. This fosters confidence among traders and enhances competitiveness by offering a broader range of trading pairs and better pricing.

Q3: What factors should be considered when choosing a liquidity provider for integration?

When selecting a liquidity provider for integration, factors such as technological capabilities, available features, pricing structure, compliance with regulatory standards, and reputation within the industry should be considered. It's essential to choose a provider that aligns with the specific needs and goals of your exchange platform.

Q4: What cybersecurity measures are essential for protecting liquidity API integration?

Implementing robust cybersecurity measures is crucial for protecting liquidity API integration. This includes measures such as two-factor authentication, encryption protocols, regular security audits, and adherence to industry best practices. These measures help safeguard user funds and sensitive data from cyber threats and hacking attempts.

Q5: How can I ensure the seamless integration of liquidity API into my crypto exchange platform?

To ensure seamless integration, thorough testing is essential. Conduct comprehensive testing of various trading scenarios, order types, and market conditions to identify and rectify any potential issues or bugs. Additionally, collaborate closely with the liquidity provider and leverage their expertise throughout the integration process.

Q6: What are the key performance indicators to monitor after liquidity API integration?

Key performance indicators (KPIs) to monitor after liquidity API integration include order latency, fill rates, slippage, trading volumes, and overall market depth. These metrics provide insights into the efficiency and effectiveness of the integration and help identify areas for optimization.

Q7: How often should liquidity API integration be tested and optimized?

Liquidity API integration should be tested regularly, especially before deploying any major updates or changes to the platform. Additionally, ongoing optimization is necessary to adapt to changing market conditions, technological advancements, and user feedback. Continuous monitoring and periodic reviews help ensure the integration remains efficient and effective over time.

Q8: What are the potential challenges or pitfalls in liquidity API integration, and how can they be mitigated?

Some potential challenges in liquidity API integration include technical complexities, connectivity issues, and regulatory compliance requirements. These challenges can be mitigated by conducting thorough research, collaborating closely with the liquidity provider, implementing robust testing procedures, and staying informed about relevant regulatory developments.

Q9: Are there any regulatory considerations or compliance requirements associated with liquidity API integration?

Yes, there are regulatory considerations associated with liquidity API integration, depending on the jurisdiction in which your exchange operates. It's essential to understand and comply with applicable regulatory requirements related to anti-money laundering (AML), know-your-customer (KYC) procedures, and data protection laws to ensure legal compliance and maintain trust with users.

Q10: How can liquidity API integration enhance the user experience and trading efficiency on a crypto exchange platform?

Liquidity API integration enhances the user experience by providing access to deeper liquidity pools, tighter bid-ask spreads, and faster order execution. This results in a smoother trading experience for users, with improved pricing and increased liquidity for their desired trading pairs. Additionally, offering a wider range of trading options and better market depth enhances trading efficiency and attracts more traders to the platform.