Beyond Bitcoin: What's Next for Cryptocurrencies?

Long-term Cryptocurrency Predictions: Opening Thoughts

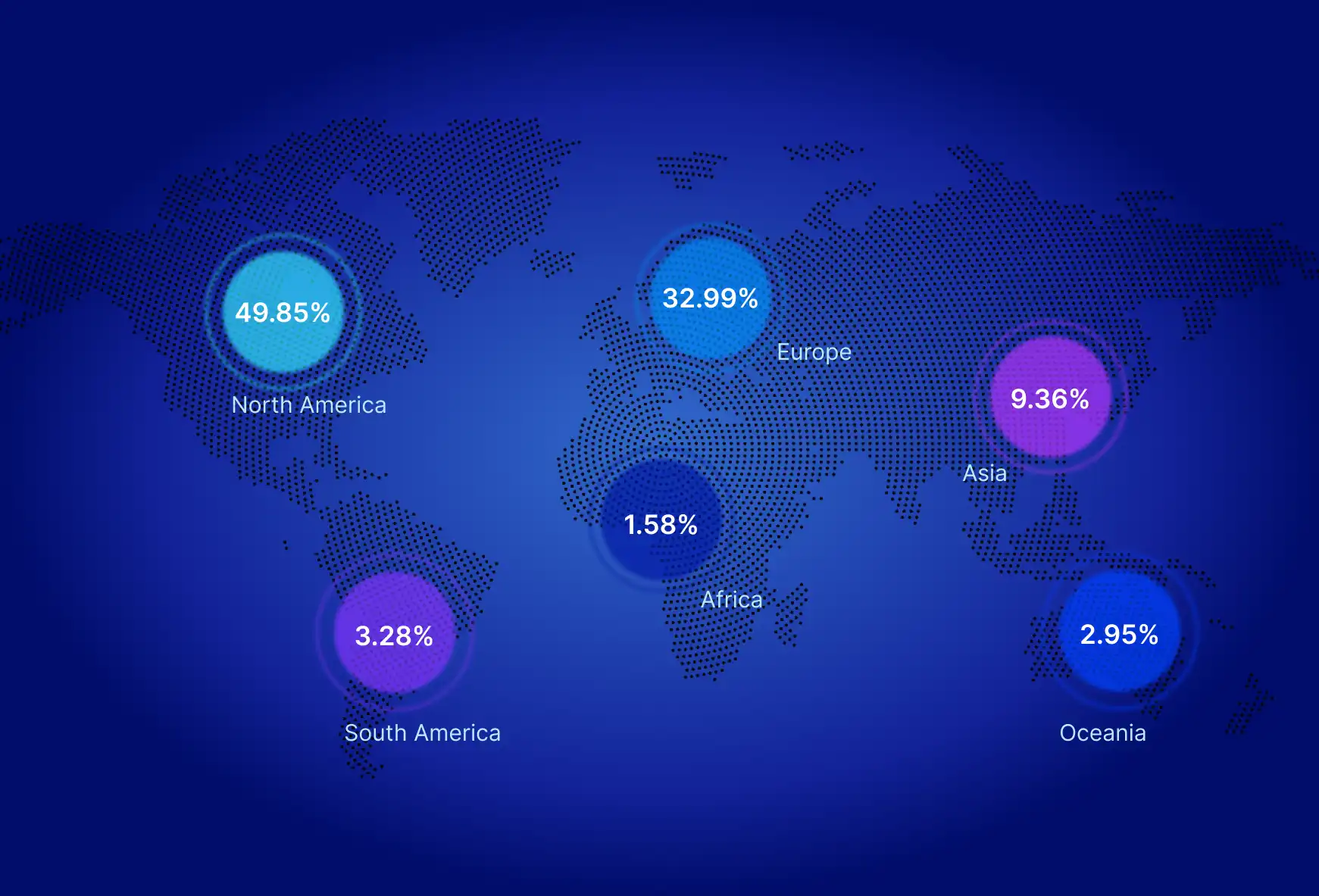

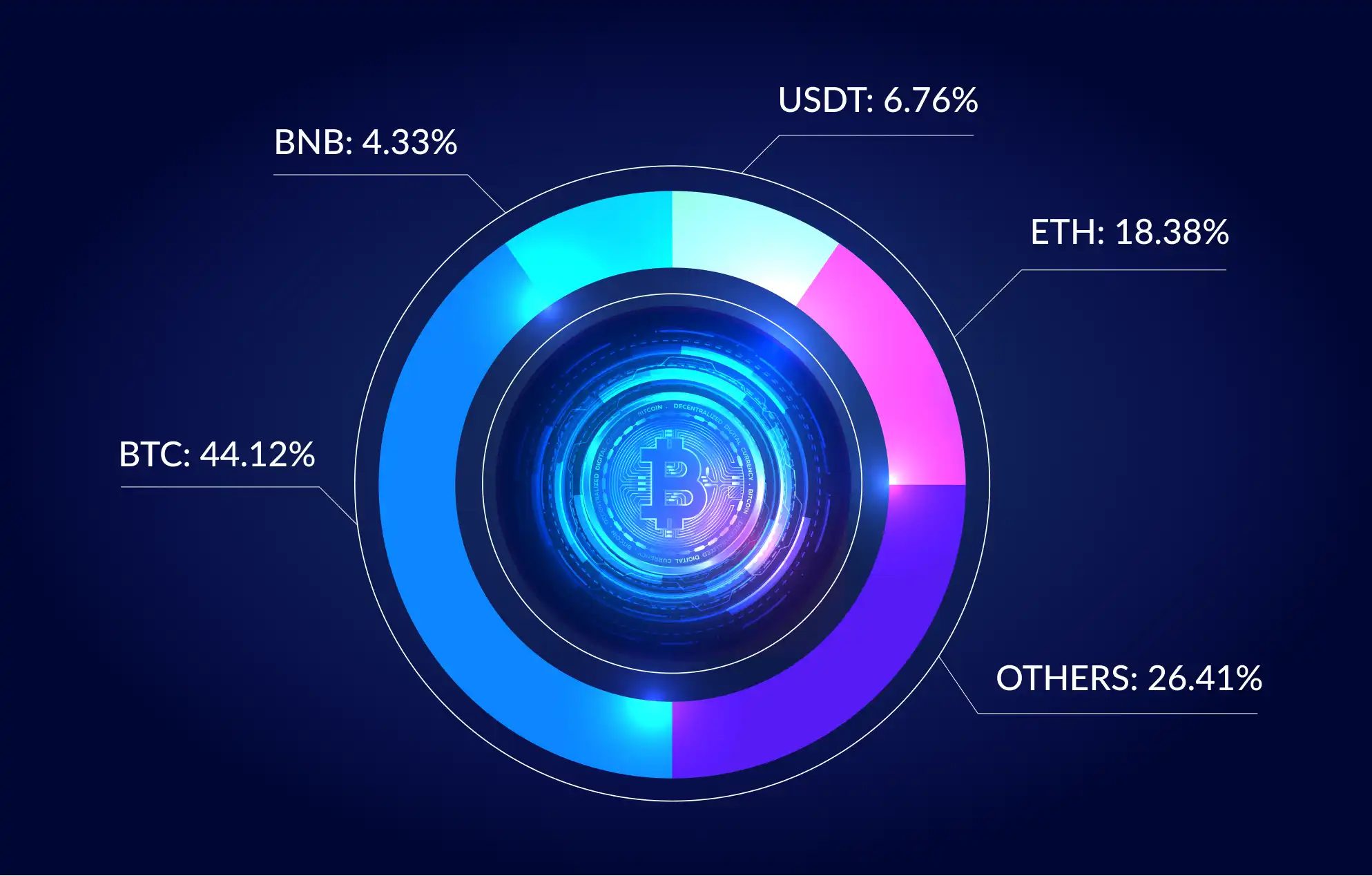

Cryptocurrency is an innovative type of digital money that has taken the investment world by storm. Since the launch of Bitcoin in 2009, the future of cryptocurrency has been a hot topic, with the crypto market growing rapidly and emerging as one of the most profitable asset classes. Cryptocurrencies are now mainstream, with more than 5,000 crypto assets in circulation. All aspects of the crypto market, ranging from the regulation of crypto assets, to the potential applications of the technology and the future of digital currencies, are highly debated topics. In this article, we will discuss the current state of the crypto market, crypto regulations in major countries, and the main concerns about cryptocurrency. Additionally, we will review five crypto future predictions that may shape the future of cryptocurrencies, as well as whether digital currencies such as Bitcoin have a long-term future.

Current State of the Crypto Market

So, is crypto the future of money? Crypto winters and crypto summers have been among the main phrases used when discussing the future of cryptocurrency and the volatile market since key events such as the launch of Bitcoin, 2017’s Initial Coin Offerings (ICOs) and the introduction of cryptocurrency exchanges, among other events. During these periods of intense volatility, the market has experienced both massive dumps, where prices have plummeted, and all-time highs, where it has gone through bullish rallies and set records. The market’s unpredictable movements have made cryptocurrency a popular asset class for traders, and made the future of Bitcoin a topic of global importance.

Crypto Regulations in Major Countries

The future of cryptocurrency is still being shaped as governments around the world respond to the widespread interest in digital assets by introducing regulations to oversee their usage and trading. Long-term cryptocurrency predictions are influenced by these regulatory models, as governments aim to strike a balance between innovation and investor protection in this evolving market.

Broadly, there are three main regulatory approaches that countries have adopted so far: welcoming the technology through laws and regulations, issuing warnings against it and completely banning it. Unsurprisingly, countries with stricter regulations are amongst the wealthiest, most advanced and most educated countries in the world. Therefore, the future of Bitcoin also depends entirely on what bills regarding cryptocurrencies will be passed by future governments.

Main Concerns About Future of Digital Currency

Security

One of the main concerns with cryptocurrency is security. Cryptocurrency exchanges are vulnerable to hacking attacks, which can result in the loss of user funds. In fact, there have been several high-profile hacking incidents in recent years. This highlights the need for robust security measures to be in place to protect user funds.

Another security concern is the risk of private keys being lost or stolen. Private keys are used to access and manage cryptocurrency wallets, and if they fall into the wrong hands, funds can be easily stolen. Many users have lost their private keys, resulting in the loss of their funds forever.

Volatility

Cryptocurrency is notorious for its volatility, which can make it a risky investment. Prices can fluctuate rapidly, sometimes within hours or even minutes, making it difficult to predict how much an investment will be worth in the future. This can be a concern for investors who are looking for more stable investments, making the future of Bitcoin more uncertain.

Regulation

The lack of regulation is another concern tied with Bitcoin's future and cryptocurrency future predictions in general. Cryptocurrency operates outside the traditional financial system, which means that it is not subject to the same regulations as traditional assets. This has led to concerns about money laundering, terrorist financing, and other criminal activities.

Governments and regulatory bodies are still trying to figure out how to regulate digital currency, and there is no clear consensus on how to do so. Some countries have banned cryptocurrency altogether, while others have taken a more permissive approach.

Adoption

While digital currencies have been around for over a decade, they are still not widely adopted. Many people are still skeptical of cryptocurrency, and it is not yet accepted as a mainstream form of payment like fiat money. This can be a concern for investors who are looking for a long-term investment, as it is not clear whether cryptocurrency will ever achieve widespread adoption.

Environmental Concerns

The mining process of some cryptocurrencies such as Bitcoin requires a lot of energy. This has led to concerns about the environmental impact of cryptocurrency mining. And while more and more coins are switching to Proof of Stake technology, the issue of environmental protection still sometimes comes up in related discussions.

Bitcoin Prospects: Can Crypto Be the Future of the Monetary System?

In spite of the existing issues, crypto has the potential to revolutionize the global financial system. Cryptocurrency allows for a secure and fast transfer of money without passing through a traditional financial institution, and without the need for excessive paperwork. This could potentially lead to more efficient financial services, and make financial transactions faster, cheaper and more secure. Furthermore, cryptocurrency could potentially challenge the dominance of traditional banks by making financial services more accessible to everyone.

So, will cryptocurrency last? What are the reasons why crypto can be the future of the financial system?

Decentralization

One of the main reasons why cryptocurrency could be the future of the monetary system is decentralization. Cryptocurrency operates on a decentralized system, which means that it is not controlled by a single entity or government. This makes it more resistant to government interference, inflation, and other economic issues that traditional currencies face.

Accessibility

Cryptocurrency is accessible to anyone with an internet connection, which means that it can reach people who do not have access to traditional banking systems. This could be particularly important for people living in developing countries or for those who are unbanked.

Security

Cryptocurrency is based on blockchain technology, which provides a high level of security. Transactions are recorded on a public ledger, and once they are verified, they cannot be altered. This makes cryptocurrency more secure than traditional forms of payment.

Efficiency

Cryptocurrency transactions can be processed quickly and efficiently, without the need for intermediaries. This makes them faster and cheaper than traditional payment methods, which can take days to process and incur high fees.

However, there are obvious problems that could become obstacles to the consolidation as the basis of the global financial system, thus undermining the future of Bitcoin and the future of digital currency in general.

Volatility

One of the main issues with cryptocurrency is its volatility. Prices can fluctuate rapidly, sometimes within hours or even minutes, making it difficult to predict how much an investment will be worth in the future. This can be a concern for investors who are looking for more stable investments.

Regulation

The lack of regulation is another concern tied with Bitcoin's future and digital assets. Cryptocurrency operates outside the traditional financial system, which means that it is not subject to the same regulations as traditional assets. This has led to concerns about money laundering, terrorist financing, and other criminal activities.

Adoption

While cryptocurrency has been around for over a decade, it is still not widely adopted. Many people are still skeptical of cryptocurrency, and it is not yet accepted as a mainstream form of payment. This can be a concern for investors who are looking for a long-term investment, as it is not clear whether cryptocurrency will ever achieve widespread adoption.

Complexity

Cryptocurrency can be difficult for the average person to understand and use. It requires a certain level of technical knowledge, which can be a barrier to entry for many people.

Top 5 cryptocurrency predictions

Increased Adoption

Over the next decade, we can expect to see a significant increase in the adoption of cryptocurrencies. More people will become familiar with them, and more merchants will accept them as payment for goods and services. This will lead to a more widespread use of cryptocurrencies in daily life.

Regulatory Clarity

As cryptocurrencies become more mainstream, governments and regulatory bodies will establish clearer guidelines and regulations to govern their use. This will provide more certainty for investors and businesses who are looking to get involved with cryptocurrencies.

Stablecoins

Stablecoins, which are cryptocurrencies that are pegged to the value of a stable asset like the US dollar, will become more popular. They provide a way for investors to hedge against the volatility of traditional cryptocurrencies while still taking advantage of the benefits of blockchain technology.

Interoperability

Over the next decade, we can expect to see greater interoperability between different cryptocurrencies and blockchain networks. This will enable easier and faster transactions across different platforms and could potentially lead to the creation of new financial products.

Central Bank Digital Currencies

Central banks around the world are exploring the possibility of issuing digital versions of their own currencies. This could potentially lead to the adoption of cryptocurrencies on a much larger scale and could also have implications for the traditional banking system.

Of course, these are just predictions, and the future of cryptocurrency is still uncertain. However, it is clear that cryptocurrencies are here to stay and will continue to be a significant force in the financial world in the years to come.

Final Thoughts: Does Crypto Have a Future?

So, do cryptos have a future? Cryptocurrencies have come a long way since Bitcoin’s launch in 2009, and the industry has experienced incredible growth in the last decade. Despite the existing issues related to regulation, security, and intrinsic value, crypto has the potential to revolutionize the global financial system by reducing transaction fees and providing accessible financial services. Additionally, the number of crypto projects and users is expected to grow.

In conclusion, the future of cryptocurrency is far from certain, but it is clear that cryptocurrencies have made a significant impact on the investment world. The regulatory landscape, technological advancements, and market trends will continue to shape the future of crypto in the next 5 years and beyond. Investors and enthusiasts alike will need to closely monitor these developments to stay informed and make informed decisions about the future of cryptocurrencies.